Knowing some Personal Finance Tips and Tricks does not mean you know it all! You’ve got to practice a consistent daily regime to savor the taste of a perfectly secure future and early retirement.

Are you struggling with money? Do you find yourself spending lavishly after payday and before you know it, it’s difficult to make ends meet? Do you have no savings despite being paid a hefty salary?

If that sounds like you, then you’re at the right place. Managing personal finances prudently is one of the biggest challenges of life. However, with the right financial tips, it is possible to manage your finances in an efficient manner.

Looking ahead to 2023, it’s important to arm ourselves with the best financial tips to achieve our goals and make the most out of our money. With the help of these best personal finance tips, mastering your finances and staying on track will be a breeze. So, be sure to read on and learn how to make your money work for you in the coming year.

Need the Motivation to set your finances straight and get Success? Here’s what the Richest in the world think!

The times demand that people be smart with money. American businessman Robert Kiyosaki, who is a true expert in personal finance management, says:

“Financial freedom is available to those who learn about it and work for it.”

Moreover, as Joe Dominguez and Vicki Robin state in their book “Your Money or Your Life”,

“It is crucial to transform the relationship with money to achieve true financial independence.”

In fact, it is true that rich people have a different mindset about money. It won’t be wrong to say that becoming rich is a matter of psychology. Take lessons from the life of richest people in the world, Elon Musk. Most of the people don’t how much money does Elon Musk make a second? With the net worth of $180 billion, he stood at the top in annual list of billionaires of 2022.

“My proceeds from PayPal were $180M. I put $100M into SpaceX, $70M into Tesla, and $10M into Solar City. I had to borrow money for rent.”

We can see how his mindset revolved around reinvesting the money he earned for a bigger profit rather than wasting it on fleeting enjoyment.

Jeff Bezos, founder of Amazon.com was famously quoted on the benefits of proper money management, saying:

“I think frugality drives innovation, just like other constraints do. One of the only ways to get out of a tight box is to invent your way out.”

Many people share the same desire. However, actually achieving that dream requires taking action and actively reinvesting your money for bigger and bigger gains. Truly, handling money is not just a simple task; it is an art form.

The Ultimate Personal Finance Tips to Get the Most out of Your Money

Here, we discuss the best ways to manage your money in detail.

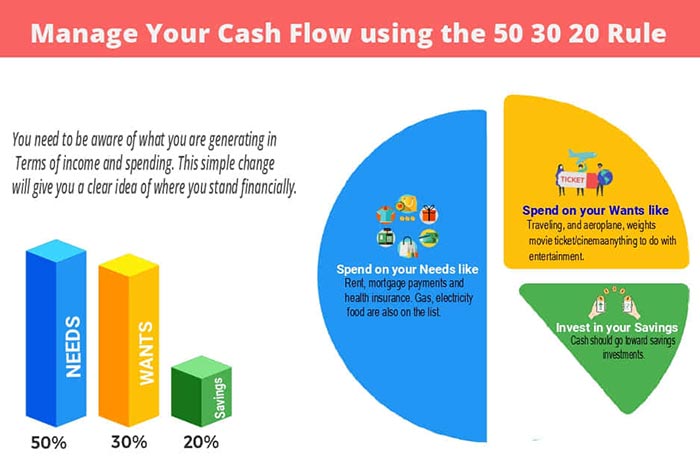

1. Follow the 50/30/20 Rule

Naturally, when it comes to finance advice, the 50/30/20 rule is a great starting point to help you manage your budget effectively. First popularized by U.S. Senator Elizabeth Warren, this rule of thumb has become widely adopted in the financial world.

By splitting your income into three distinct categories, you can ensure that you’re spending your money in a way that makes sense for your needs and priorities. Specifically, you should aim to spend 50% of your income on necessities like rent, mortgage payments, health insurance, and other essential expenses. Another 30% of your income should be allocated towards your wants, such as travel, hobbies, and entertainment.

Finally, you should set aside 20% of your income for savings and investments. While you don’t have to stick to these exact numbers, following this categorization will help you stay on track and achieve your financial goals over time. This portion can also contribute to your financial future and estate, securing resources for retirement or passing on a legacy.

2. Separate Savings from Checking Account

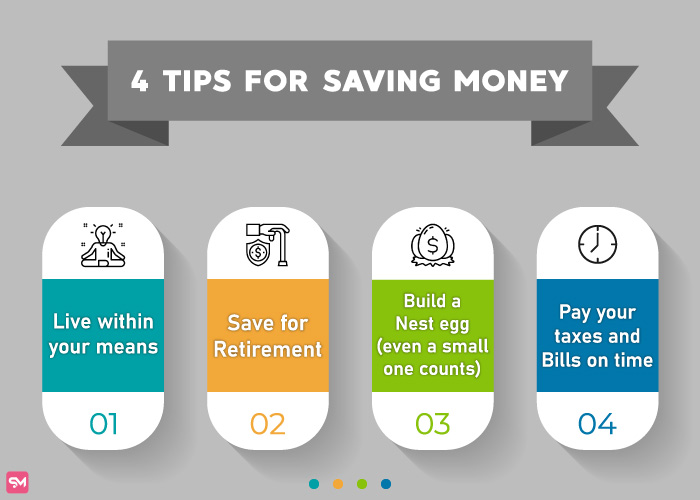

For those looking for tips on personal finance, saving money should be at the top of the list. Coming up with the right savings plan gets you closer to your financial goals. So, what are the best tips for saving money?

First of all, use budgeting apps or a spreadsheet to keep track of the amount of money you are earning, investing, and saving. Second, when it comes to money advice, separating your savings from your checking account is very high on the list.

It doesn’t matter if the two accounts are in the same bank or not, as long as you stick to keeping them apart. While it may be inconvenient for some; still, it makes saving a lot easier. Moreover, a savings account should be left alone unless there is an emergency.

It is also crucial to find the right balance between checking and savings account money. It makes sense to leave about two months’ worth of living expenditures in a checking account. Dave Ramsey, an American Bestselling author, businessman, and personal finance figure suggests keeping at least 6 months of expenses in the emergency funds untouched.

3. Earn Returns by Putting Money in a Savings Account

Personal finance ideas can help you maximize your savings and investment potential. One great way to do this is by putting your money in a savings account. While keeping money in a checking account is convenient, it doesn’t offer the same returns as savings and retirement accounts. In fact, some banks offer Savings Builder accounts with even more benefits than traditional savings accounts.

Moreover, more and more people are self-employed and looking for early retirement. For them, it is even more crucial to get extra returns on their savings. Plus, 401(k) plans are still dominating this sector. Once you cross six months’ worth of savings, you could start thinking about opening another retirement account. Obviously, it is up to you to find the proper parameters that work best for your situation.

4. Don’t Fall for the Influencer Trap

For young adults, advice on personal finance is essential in today’s world, where social media and technology have made it more challenging to save money. It is tempting to spend money on things we don’t need when we see influencers living a lavish lifestyle online.

However, according to Forbes, young Americans between 18 and 29 owe a collective $1.08 trillion in debt, mainly due to credit card and mortgage debts. It’s crucial to live within your means to have a better and more secure future. Don’t follow a particular lifestyle just because it’s trendy or glamorous. Stick to what you can afford and avoid accumulating debt. Remember, the key to successful personal finance is to manage your expenses and save for your future.

Other personal finance tips for college students and young adults include the need to start saving for retirement as early as they can. And, always keeping an eye on putting some money aside even if it’s very little.

In addition, it is never too early to start thinking about the future. Another element is to not ignore your taxes and to pay your bills on time. This will ensure that you don’t pay late fees.

In short, the best way to manage your personal finances is to be proactive.

Can Money Really Buy Happiness?

Indeed, people try to copy influencers because they are rich, famous, and happy. Supposedly, they are successful, and don’t we all want the same? However, many people will tell you that money can’t really buy happiness. In fact, a survey revealed that only 1/5th of Americans believe that money can buy happiness. Even Bill Gates commented on this saying,

“Money has no utility to me beyond a certain point.”

Personal financing tips can help you improve your financial situation without having to become a billionaire philanthropist. While money doesn’t necessarily bring happiness, it does reduce stress and provide stability. Financial stress has been linked to higher levels of psychological distress, so improving your personal finances can also improve your mental well-being. With better financial stability, you’ll have the freedom to pursue what makes you happy in life. Remember, building organizations to help those in need is also a great way to use your money for good.

5. Be Savvy and Save Money on Groceries

Looking for ways to save money on food and groceries in the year 2023? With inflation being a global problem, it’s becoming increasingly difficult to maintain a budget. But don’t worry, we’ve got some tips to help you out.

First, consider buying in bulk to save money in the long run. You could also try shopping at discount stores or taking advantage of sales and coupons. Another option is to grow your own food if you have the space and time. Not only is it a fun hobby, but it can also save you money on fresh produce.

Finally, consider meal planning and prepping to avoid wasting food and money. With these money-saving tips, you can still enjoy delicious food and groceries without breaking the bank.

- Keep a lookout for items that are on sale.

- Prepare a grocery list and make sure you stick to it.

- When you are at the grocery store, have a calculator nearby to track your spending.

- Compare prices between different grocery stores.

- Only shop at grocery stores and supermarkets. Avoid convenience stores as they tend to be more expensive.

- Purchase generic brands rather than big-name, famous ones for cheaper prices with almost identical quality.

6. Managing Your Cash Flow is Paramount to Good Personal Finance

Managing your money the right way, first and foremost, requires a clear analysis of your current financial situation. The other personal finance tips will only work once this honest assessment has been made.

Increase Self-control And Limit Your Spending

Financial tips for beginners are crucial to make sure they have a sound financial footing. One of the most important things to keep in mind is self-control when managing your money. A simple way to boost savings is to cut back on your expenses. Avoid buying unnecessary things and instead, focus on your needs.

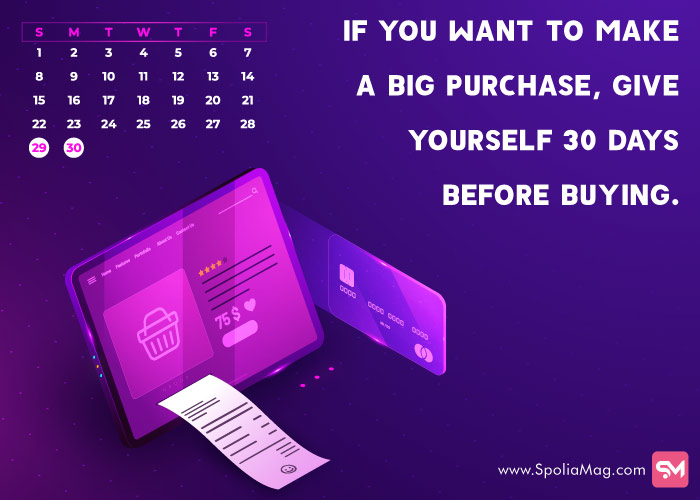

However, this can be a challenging task that requires self-discipline. Many people just enjoy sharing hilarious money memes online instead of taking practical action. To counter impulsive behavior, it is recommended to pause and give yourself time to think before making a purchase. Financial advisers suggest following the 30-day rule. If you want to make a big purchase, wait for 30 days before making a move. If you still want to buy the item after a month, it is probably the right call.

On the other hand, if you have forgotten about it, then you have saved yourself some money. Remember, self-control is paramount to keeping your finances in order.

Furthermore, it is best to set priorities. Instead of buying items that lose their value, focus on getting new experiences that are priceless, like a visit to the local museum, taking your dream vacation abroad, or spending quality time with your loved ones.

There are many activities that are free where you can get more satisfaction than from buying a material object. To accomplish this feat, delayed gratification is essential.

Another area where self-control is key is your reaction to receiving a big sum of money, like on a payday. Staying calm and resisting the urge to spend most of it, is a really important personal finance tip. In essence, self-control helps you be wise in the way you approach money; and the way you decide to spend it.

Making More Money Means More Savings And Investments

Managing money efficiently is also about finding ways to improve your financial situation.

- You can try to get a salary raise at your current job. Increasing your hours could mean more cash in your pockets.

- Launching a side hustle is a very popular route these days. Sometimes, the side hustle even becomes your primary source of income.

- Delivering groceries or walking dogs are activities that can bring additional income.

- Some people even find ways to earn extra cash by selling things on eBay.

How to Share Money

Managing money can be a challenge, especially when it comes to relationships. However, there are ways to make it less complicated. Here are some tips on how to manage money better in a relationship:

- Communication is key. By setting ground rules about money early on, you can avoid surprises and conflicts later on. Make sure you discuss your views about money clearly and understand where your partner stands on spending and saving.

- Understanding each other’s finances is also important. This can help you know what you’re getting yourself into and avoid any misunderstandings down the line.

- Protecting your assets is essential, even when your relationship is strong. Consider signing a prenup before marriage to manage your money wisely.

By following these tips, you can manage your money better in your relationship and avoid any unnecessary stress or conflicts. Remember, open and honest communication is key to a healthy financial relationship.

7. Protect Your Money for a Strong Economic Situation

Regardless of how the economy is faring, you need to know how to protect your money.

Get professional help from Personal Finance Consultants

Getting good financial advice from an expert can be essential in achieving your financial goals faster. A pro can guide you on how to protect your money in the long run and show you ways to get the best returns. They have the expertise to know where things are headed and can advise you on your next best move.

For example, an important personal finance tip that a pro might give you is to stay calm when the stock market is going through a rough patch. It is always best to take a long-term view of the situation. There is no need to rush and dump your stocks because of an economic downturn. Such a move may feel reassuring, but it might undoubtedly cost you more money. If your portfolio is diversified in the right manner, you should recoup your investment after things settle.

Leaving your money alone for a period of 7 years is more profitable. However, if you are close to retirement, you might want to go a different route and not wait for the rebound. A professional can make these difficult moments less tense by keeping the focus on the bigger picture.

This is also true for the way you handle your debts. It is best to come up with a debt plan. Taking help from a professional financial advisor will greatly benefit you in this case.

Beware of Scammers and Con-artists

To protect your money, you need to be careful of scammers. To do so, check your bank accounts daily. Plus, never give your personal information to unscrupulous people. Moreover, make sure your computer is protected; and do not click on links that are not trustworthy.

8. Practise Best Budgeting Practices for Optimal Personal Finance

Budgeting is a very important step in personal finance. You need to know how to budget your money the right way.

Create a Targeted Budget

When it comes to personal finance advice, tracking your net worth and setting a targeted goal is crucial. This could mean paying off student loans or mortgages or having a specific amount saved up by the end of the year. Regularly updating your budget is key to staying informed and on top of your game.

Thankfully, there are budgeting apps available, like Personal Capital, that can simplify the process and make a huge difference in how you manage your finances. These tools help keep you accountable and on track toward achieving your financial goals.

Take Care of Your Credit Score

One of the most shared personal finance tips is about the need to maximise your credit score. In order to accomplish this, you need to understand what is a good credit score and the content of a credit report. Credit Karma, a personal finance firm, offers a free assessment as a starting point that you should check out.

In a nutshell, a credit score over 700 is good. When you get over 800, it is considered excellent. While calculating your credit score, the following things are considered:

- 35% payment history, for example, whether you make payments on time or not.

- 30% amount owed; this includes all of your dues and credit card debts combined

- 15% length of credit history; lenders and banks prefer long credit history as it gives them more data to base their decisions upon. If you have a long history of making timely payments, your credit score will be very high.

- 10% credit mix; this consists of all types of loans you owe such as credit cards, bank accounts, home loans, etc.

- And lastly, 10% new credit; your recent credit history also plays an important role in your credit score. if you’ve recently opened too many accounts or taken multiple loans will reflect badly on your credit score.

Improving your credit score will make it easier for you to get certain loans and better interest rates. That’s why it is important that you stay on track with your finances and do not neglect your payments.

9. Be Smart about Investing Your Money for a WIN-WIN Situation!

Gone are the days when investing was just limited to the stock market. Today, there are a number of alternative investments available that anyone can tap into regardless of their economic profile. When looking for investment advice, you should consider yourself as an asset too. Making money work for you is an art that once mastered pays lucrative dividends.

Invest in Yourself

Finance is no different than many other things in life. The more you know, the better it is for you. A great personal finance tip is to invest in yourself before you start making other moves. For example, financial literacy is very important. You can work on your financial education by taking some classes or buying a few personal finance books. This can help you master your money which will further help you come out ahead in the long run.

Financial education will make it possible for you to understand key investment terms that you will need for your money to grow and reach its full potential.

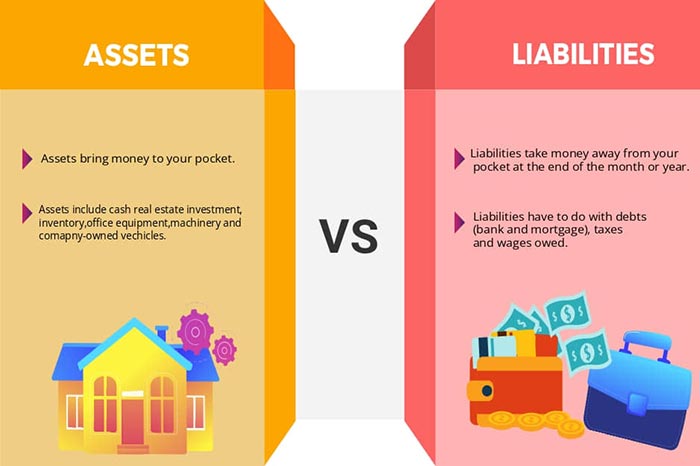

A good example is understanding the difference between assets and liabilities.

Assets vs. Liabilities

In short, assets bring money to your pockets, while liabilities do the opposite.

Opposite to popular belief, your house can actually be a liability instead of an asset if it is taking money away from your pocket at the end of the month or year. Contrarily, if you have a real estate property rented out; and receive a great return on investment as a landlord, after taking care of taxes and maintenance. Only then can you classify your property as an asset.

Additionally, assets include cash, real estate, investments, inventory, office equipment, machinery, and company-owned vehicles. Liabilities have to do with debts (bank and mortgage), taxes, money, and wages owed.

Read More: Assets to Buy in your 20s

Smart Ways to Invest Money for Maximum Profit

You need to know where to put your energy and focus if you want to get the most out of your money.

Explore Investment Options Outside of the Stock Market

The stock market is one of the first areas where people look when they are ready to invest. While it is an excellent place to invest for your retirement, other options do exist, such as investing in Real estate investment trusts. For beginners, it is wise to start learning by assuming a high-paying role in REITs. It will not only give you a complete understanding of REITs but also make you a more prudent investor.

Have Goals for Your Money

You are ready to invest. Here is one of the top tips for personal finance: you need to have different sets of goals for your money. Long-term objectives are those over five years. Short-term goals correspond to anything under five years. You always need to have a vision and know what you want to get out of your money. Is it for your dream home? Or are you just focusing on next year’s vacation?

Can You Do It on Your Own?

After knowing your objectives, you need to decide if you are ready to handle an investment portfolio on your own. While going solo is possible, it is not for everyone. A professional might be able to map things out for you in the correct manner.

Summing It up

Rarely do people stop to think about their financial situation. Indeed, most people are too busy chasing momentary pleasures and avoiding the crippling anxiety of living from paycheck to paycheck and surmounting debts to truly evaluate their finances, much less take actions to improve them. For the golden few who’ve made it through this article, keep your eyes on the goals. And, soon financial freedom, early retirement, and great returns on investments; all will be within the back of your hand!

FAQs

The first and easiest step to improving your credit score is to pay all your bills on time. If you have a history of consistently paying your dues on time, it will significantly reflect on your credit rating.

This depends on how responsible you are with credit cards. People who are not responsible with money and credit cards should not have more than two or three.

The majority of Americans live from paycheck to paycheck. It’s a financial crisis if they suddenly get laid off. Therefore, take into account all your essential expenses like rent, mortgage, utility bills, groceries, car payments, healthcare, etc. And keep at least 4 months’ worth of expenses in your emergency funds.

Yes! Retirement savings is all about time. The more time you spend saving, the more you will have.

This depends on the retirement lifestyle you want for yourself as well as the economy. You can save millions of dollars for your retirement but inflation will continue to increase and make your money less valuable.

Essentially, you can reduce your taxes by matching your annual gains against financial losses. Having a financial or tax advisor can really help you with this.

Calculate the total amount of debt you have and divide it by your total income. Finance experts believe that having a debt-to-income ratio below 43% is good. But in essence, the lower this ratio is, the better.

Generally speaking, no debt is good. However, you need to make a strategic decision before taking a loan; whether or not it improves your quality of life and how will it contribute to you building a better life for yourself.

Short-term goals are making your next debt payment on time, while long-term goals are being completely debt free in 10 years. Basically, short-term goals are the steps you take in order to achieve your final long-term goals.