What does it take to get into the league of the richest people in the world? – is a question some of us might ponder sometimes and promptly forget about because it is so wild. The world of the rich is so distant and different from the lives of ordinary people that we can only see and hear about it either in the news or movies. There are several movies about money that depict the luxurious lifestyles of the ultra wealthy, shaping our perceptions regarding wealth.

Regardless, it is true that billionaires steer the direction of our society. They’re the ones with the biggest responsibilities. Though most of them don’t care about anything maximizing their profits, some (Elon Musk, Bill Gates) do think far ahead into the future and are trying to help humanity to their capacity.

So, let’s take a look at the top world billionaires, and maybe it will inspire you to save up your own money, invest, improve your finances, and join their ranks!

Fun Fact: A report from the Hurun Global Rich List 2024 says that the United States isn’t the country with the most billionaires anymore. China surpasses it with 814 billionaires against 800 in the U.S. Besides, India, the UK, and Germany also have a good number of billionaires.

Here are the top richest people in the world according to the Bloomberg Billionaires Index.

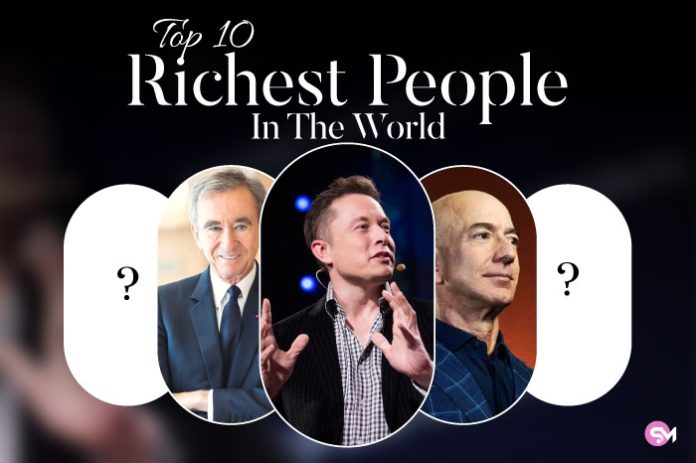

The Unsurprising List of the World’s Wealthiest People in 2025!

Here are the top richest people in the world according to the Bloomberg Billionaires Index.

Note: The figures mentioned in this article are accurate as of February, 2025, and can fluctuate as per the market valuation of their companies.

1. Elon Musk

Elon Musk remains the world’s richest man. He lost 48% of his net worth when he purchased Twitter, leading him to step down to second spot in the list of richest persons. However, he recovered his lost worth and now his total wealth is around $349 billion with an annual earning of around $18.3 billion!

His total net worth declined quickly after reaching $421.2 billion at the start of this year. Forbes reported that he added $91 billion since December 1.

Musk is known for doing things differently in business and tech space. He’s also known for steering humanity’s exploration of space as the CEO and Chief Engineer of SpaceX.

| Source | Tesla, SpaceX, The Boring Company, and X (formerly Twitter) |

| Net Worth | $349 billion |

| Age | 53 years old |

| Country | United States of America |

2. Mark Zuckerberg

Mark Zuckerberg is the only billionaire in 40s on this list. The 40-year-old is the CEO and chair of Meta Platforms. He co-founded Facebook in 2004 when he was a student at Harvard University that eventually lead to become teenage millionaire.

Besides Facebook, Meta platforms include Instagram, WhatsApp, Oculus (VR headset producer), and Workspace (enterprise-connectivity platform).

| Source | Meta Platforms |

| Net Worth | $237 billion |

| Age | 41 years |

| Country | United States |

3. Jeff Bezos

The most notorious billionaire, Jeff remains in the top five of the chart of richest people in the world. He is the founder of Amazon.com – the world’s first and biggest online shopping site.

After stepping down as the CEO of Amazon in 2021, he went on space exploration via a rocket developed by his private aerospace company, Blue Origin. The billionaire has also purchased a luxury superyacht, koru, for 500 million dollars in 2023.

| Source | Amazon, The Washington Post, Blue Origin |

| Net Worth | $253 billion |

| Age | 61 |

| Country | United States of America |

4. Bernard Arnault and Family

The French luxury goods tycoon stands second among the richest people in the world. He is the CEO and chair at LVMH, the world’s renowned luxury goods company. LVMH holds over 70 cosmetics and fashion brands under its name, including Louis Vuitton, Christian Dior, Marc Jacobs, and Sephora.

Arnault dethroned Elon Musk to become the richest person in the world in December 2022, a title he held till February 2023. Musk then took over, but Arnault regained it in July 2023 till October 2023. As of 2025, he is now the ourth richest with a net worth of $195 billion.

| Source | LVMH, Moelis & Company Equity, Christian Dior Ownership Stake, Hermès equity |

| Net Worth | $195 billion |

| Age | 76 years old |

| Country | France |

5. Larry Ellison

Real Estate Property Investment – one of the most profitable industry for investors. And Ellison holds more than $17.2 billion in real estate. The Hawaiian Island of Lanai and a $173 million luxury mansion in Florida are a few of his assets.

He also owns Oracle, the second-largest software company in the world. Ellison also served on the Tesla board of directors from 2018 to 2022.

| Source | Oracle Corporation, Tesla equity, Real Estate |

| Net Worth | $193 billion |

| Age | 81 years old |

| Country | The United States of America |

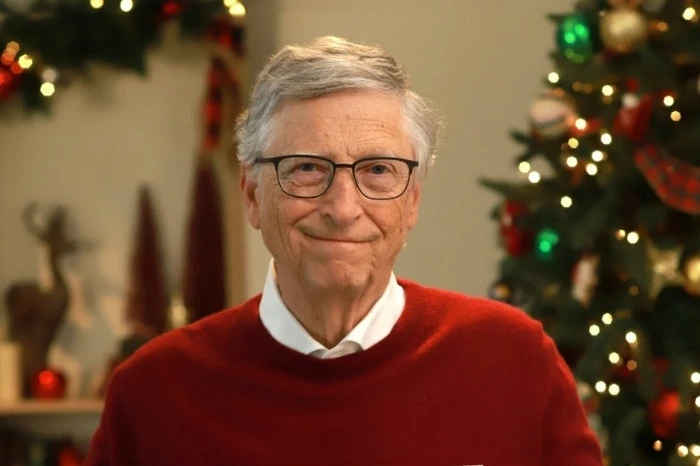

6. Bill Gates

Think “personal computers,” think Bill Gates. Even though he stepped back from the daily grind at Microsoft ages ago, he’s still this giant of a figure. But his story’s way bigger than just tech. Beyond building that company that totally revolutionized how we all live and work, Bill Gates is now known worldwide for his incredible philanthropy with Melinda (though they’re divorced now, of course). Through the Gates Foundation, he’s taking on some of the planet’s toughest challenges.

He is wiping out diseases like polio and making sure kids everywhere get a better education. And while his focus now is on making a global impact, let’s not forget – his success at Microsoft changed the world. Just how successful? Well, even today, Bill Gates is still the sixth richest person on Earth, with a mind-boggling net worth of around $166 billion. Let that sink in.

| Source | Microsoft |

| Net Worth | $166 billion |

| Age | 69 years old |

| Country | The United States of America |

7. Larry Page

Larry Page, the co-founder of Google, is the seventh among the top 10 billionaires. His net worth soared from just below $52 billion in March 2020 to the current $156 billion. Page is a board member and major shareholder of Alphabet, Google’s parent company.

The billionaire is also interested in space exploration and flying cars. He is a founding investor for Planetary Resources, an aerospace company, Kitty Hawk, and Opener, a flying car startup.

| Source | Alphabet Inc. |

| Net Worth | $156 billion |

| Age | 52 years |

| Nationality | The United States and New Zealand |

8. Warren Buffett

At age 94, Buffet is 8th on the billionaire list. He is also the most famous living value investor, making billions by buying and holding companies. His company, Berkshire Hathaway, has a diverse portfolio of subsidiaries, including insurance firms, restaurant chains, energy distribution, and consumer products.

| Source | Berkshire Hathaway |

| Net Worth | $155 billion |

| Age | 94 years old |

| Country | USA |

9. Sergey Brin

Sergey Brin, the co-founder of Google, stands as the ninth-richest individual globally, boasting a formidable net worth of $147 billion as of Feb 2025. Born in Moscow, Russia, Brin co-founded Google with his Stanford colleague, Larry Page.

Brin stepped down as the President of Alphabet in 2019. He is a board member and major shareholder and remains deeply involved in the company’s operations.

| Source | Alphabet Inc. |

| Net Worth | $147 billion |

| Age | 51 years |

| Country | United States |

10. Steve Ballmer

Los Angeles Clippers owner, Steve Ballmer has a total net worth of $147 billion and is, right now, the 10th richest individual on earth. The US businessman joined Microsoft in 1980 and became its CEO in 2000 till he stepped down in 2014.

Besides his shares in Microsoft and his Clippers basketball team, Ballmer also owns The Forum and Intuit Dome.

| Source | Microsoft, Los Angeles Clippers, The Forum |

| Net Worth | $147 billion |

| Age | 68 years |

| Country | United States |

Also Read: How to Become a Teenage Millionaire

The Bottom Line

The world of the rich is fascinating as it is distant. It is always interesting to know who is at the top and who bit the dust. The rise and fall of these companies is a great lesson in finance for us all.

READ MORE: How to Save Money as a Broke College Student

Images from: Wikimedia Commons